Gloria Dickerson wants to change the way people think. It’s no easy task, particularly when it comes to encouraging low-income communities to dream bigger than the world they know. However, Gloria Dickerson is no stranger to adversity.

Gloria was born into an impoverished family of sharecroppers in Drew, Mississippi. She was one of 13 children, and although her family was poor, Gloria says her most valuable assets as a child were her parents. Her mother, Mae Bertha Carter, was active in the Civil Rights Movement and The National Association for the Advancement of Colored People (NAACP). Mae Bertha Carter made clear in action that she wanted better for her children.

Gloria Dickerson standing next to a photo of her mother, Mae Bertha Carter.

“She didn’t like being a sharecropper, being hungry at night,” Gloria said. “And she didn’t like it when the plantation owner came by and told her that her children couldn’t go to school because they got to get the cotton out of the field. She knew that wasn’t right, and she made it up in her mind that her children were not going to have to live in poverty for the rest of their lives the way she had come up. She didn’t know how, but she was determined.”

In 1964, it became clear what it would take to break Mae Bertha Carter’s family’s cycle of poverty: sending her kids to integrate the Drew School District.

Although Brown v. Board of Education had found segregation of children in public schools unconstitutional in 1954, the Supreme Court decision had largely left it up to states to decide when to integrate their schools. Come 1964, however, states like Mississippi still hadn’t taken any action, prompting the Federal government to threaten to pull federal funding. That’s when the Drew School District adopted what was called Freedom of Choice, which meant that families in the district got to choose where to send their children to school.

In 1965, Mae Bertha Carter chose to send her seven school-aged children to the all-white school, where she knew they’d get a better education. The FBI followed the children to school for the first week, after which they decided the family was safe. That couldn’t have been farther from the truth.

Gloria and her siblings, spread between first grade and eleventh grade, were the only Black students in the school. Their peers threw chalk at them and showered them with spitballs. White students terrorized them in the hallways and called them terrible names, at home things were even worse. People fired guns into the house so that the family had to resort to sleeping on the floor, and people plowed their gardens and released their pigs. The family was even evicted from the plantation where they lived and worked.

Gloria and her siblings, spread between first grade and eleventh grade, were the only Black students in the school. Their peers threw chalk at them and showered them with spitballs. White students terrorized them in the hallways and called them terrible names, at home things were even worse. People fired guns into the house so that the family had to resort to sleeping on the floor, and people plowed their gardens and released their pigs. The family was even evicted from the plantation where they lived and worked.

“My momma used to get on the bed every day,” Gloria said, “and she’d pray when we got on that school bus, and say ‘please Lord, please send my kids home safely.’ Then, at the end of the day when we’d get off the school bus, she’d be there, counting us one by one because she didn’t know if all of us would be coming home or not.”

Gloria says that people did everything they could to try to stop her and her siblings from going to school and to change their minds. In the end, it didn’t work. Instead, the family not only kept sending its kids to the formerly all-white school, but in 1967, it sued the school district on the grounds that it was an intolerable burden on children to have to go through what Gloria and her siblings had to go through to get an education. Gloria’s family won the lawsuit, and the Drew School District threw out Freedom of Choice and school-based segregation in 1969.

When asked, Gloria refers to her time in the all-white high school as both the best and the worst of times. Amidst the external struggles and the social upheaval taking place around her, she learned how to be in solitude and in silence, and she picked up important study skills. She got her education, and one by one, Gloria and her siblings received NAACP scholarships to attend the University of Mississippi, better known as Ole Miss. Each of them later walked across the graduation stage, diploma in hand.

Gloria passed the Certified Public Accountant (CPA) exam and later returned to school to get her M.B.A. On paper, she’d done it — she’d succeeded in accomplishing something and pulling herself up to the middle class. In 1999, she got a job as a corporate controller with Kellogg Foundation. Five years, later, however, she was ready to get out of the back office and back into the community. The foundation sent her to Jackson, Mississippi to be a program officer, where she coordinated capacity-building efforts with community-based organizations across the Mississippi Delta.

That all came to an abrupt end, however, when the Mid-South Delta division of the foundation she worked under was dissolved in 2009. Gloria was forced into an early retirement, which raised some big questions for her. She knew she wanted to be in the field, working with people and giving back to her community. She also knew that every time she visited her mother in Drew, most of the people she saw continued to live in the same poverty that she’d escaped.

“I’d go visit my hometown and say ‘they shouldn’t have to live like this,’” Gloria said, referring to the dilapidated houses, the lack of grocery stores and fresh produce, and the dismal state of the public schools. “We fought so hard in that classroom, but I looked back and said ‘what good did that do?’ It did me some good and it did my family some good, but the job is not over.”

Gloria started a nonprofit called We2Gether Creating Change and decided to return to her community in Drew so that she could show people how to escape poverty and teach them how to thrive.

Leading By Example

Gloria had her work cut out for her.

Given her professional background, she knew that foundations were somewhat disillusioned with the Mississippi Delta, because no matter how much money they poured into the region, nothing seemed to change.

“When I’d ask them why do you think things aren’t changing, they’d say ‘those people down there need to start thinking differently about their life situation,’” Gloria said. “So, when I started my organization, I wanted to address what those foundations said was the issue: the way people think, and their mindsets, value systems, hopes, dreams, and imaginations.”

Upon returning to Drew, the first thing Gloria wanted to do was to teach school children about their local history. Gloria wanted to teach the kids about the community they’d been born into, and she wanted to share with them how her family was able to use education to lift itself out of poverty. Those history lessons quickly morphed into conversations about self-worth, self-esteem, leadership, life skills, career tracks, etiquette, relationships, and abuse.

It didn’t take Gloria long to learn that most of her students had never been outside of Drew. That proved problematic, because when she asked them to dream, they had no idea what she was talking about. Therefore, once a year, she started taking groups to Orlando, Florida: to show the kids what middle-class life looked like. They’d go to Universal Studios and to Disney World so that the students could start to imagine a different future for themselves. For eight consecutive years, until the COVID-19 pandemic, Gloria and her team took 100 kids per year to Florida.

“A lot of those kids have gone to college, and some of them have gone back to Disney World with their own kids and families on their own,” Gloria said. “Some are nurses and biologists, and a lot of them tell me ‘if you hadn’t shown me what we could do, I never would have been where I am.’”

Over the years, Gloria’s work with middle and high school students in her community expanded across her community. She began to work with elementary-aged students to help improve their reading levels and she started to work directly with her students’ parents and other adults in Drew, so that they too could begin to change their mindsets. The classes she coordinates range from financial literacy to mindfulness and meditation. However, Gloria knew that if she was truly going to help her community move from poverty to prosperity and from hopelessness to hope, then she was going to also have to find ways to make tangible, physical improvements to Drew to show people that change is possible.

You Have to Give Them Hope

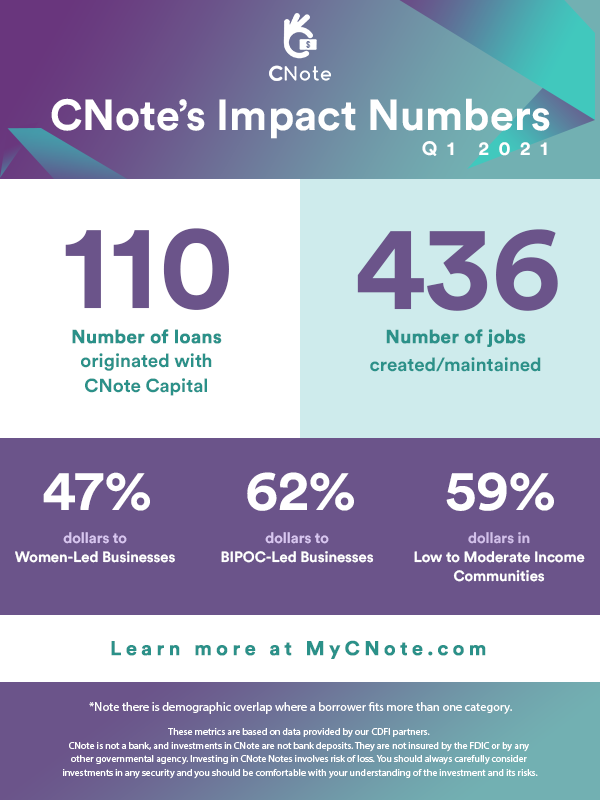

That’s when Gloria called HOPE, a credit union that has generated more than $2.5 billion in financing to benefit more than 1.5 million people across Alabama, Arkansas, Louisiana, Mississippi, and Tennessee. CNote partners with credit unions like HOPE across the country, working together to mitigate the extent to which factors like race, gender, and birthplace limit one’s ability to accumulate wealth. Together, HOPE was able to help Gloria and other concerned citizens in Drew make improvements to their community.

“We didn’t have any playgrounds,” Gloria said, “and the grocery store had closed, so we had no way to get a banana. We didn’t have any affordable houses, and the neighborhood and streets looked like a mess with these dilapidated houses. All of this stuff affects the way people think: it’s their environment. But just because they’re poor doesn’t mean they don’t want to have a place to play or sidewalks.”

The first thing HOPE did was help Gloria and her new group, the Drew Collaborative, to finalize a strategic plan that they could then use to present and send to funders. More so, HOPE funneled grant dollars into Drew, which went toward tearing down decrepit houses and building affordable homes in their place.

HOPE also brought in KABOOM! to build a playground, and the collaborative is currently working to open both a grocery delivery distribution center and a telemedicine center in Drew.

In the wake of the COVID-19 outbreak, HOPE also provided Gloria with a Paycheck Protection Program (PPP) loan to keep her two staff members at We2Gether Creating Change employed. The nonprofit has shifted away from in-person classes and gatherings, and because most people in her community don’t have computers or the internet, going online isn’t possible. Still, Gloria and her team have been distributing disinfectant, masks, gloves, and soap around the community, and because of the PPP loan, they’ve been able to keep their food pantry open.

“If it wasn’t for HOPE, I would have had to lay off my employees,” Gloria said. “I’m glad I was able to keep them, and I’m grateful that we were able to get that funding, because we wouldn’t have been able to continue with things unless I was able to keep those two on.”

Dreaming Beyond The Pandemic

Whereas the coronavirus pandemic has turned much of her world on its head, if there’s one thing that Gloria is grateful for over these past few months, it’s the time she’s been given to step back and to think about the future of We2Gether Creating Change and of Drew, Mississippi. According to her, she wants her nonprofit to get more into racial equity work. That includes acquiring the barn where Emmett Till was killed and turning it into a museum or a retreat center — a place in the community that pays tribute to him. She’d also like to restore a small jail in Drew that was used to imprison some of the Freedom Riders back in the 1960s. It all ties back to the initial work that Gloria started in the community when she moved home in 2009: teaching people about their local history so that they can use education as a vehicle to escape poverty.

As for Drew, Gloria wants to leverage her position as a Sunflower County district supervisor to improve the town’s infrastructure and aesthetics. It’s a difficult task, but still, it’s something that Gloria is committed to.

“I need to do this,” she said. “I need to work in this community and try to help people and serve people. I’m passionate about it because I know what it was like for me trying to grow up in poverty and how hard and painful it was. Even if I can help anybody else to not have to go through that, then that’s what I want to do. That’s what drives me.”

Gloria and the We2Gether Creating Change Team

It’s that same drive that led Gloria to spend her first eight years with We2Gether Creating Change without paying herself a salary. In fact, she’s poured in well over $500,000 of her own money to fund trips to Disney World, distribute scholarships, provide student stipends, pay course instructors, cover overhead expenses, and much, much more. She’s received some financial support from Kellogg Foundation, her previous employer, and other donors, but given Gloria’s aspirations for her community-based work in Drew, she’s going to need more help from foundations that aren’t afraid to invest in her philosophy.

After all, she doesn’t have to look far to see that her approach works. It’s evident when Gloria returns to Ole Miss for graduation ceremonies to watch her students walk across the stage and receive their degrees, just like it’s visible during her trips to Disney World, when she sees kids laughing and playing and having a good time in a place far, far away from the poverty of Drew.

“To see them there with that smile on their face,” she said, “that is what being out of poverty means. That’s really joyful for me, when I see people benefiting from things we’ve done and accomplishing things on their own. I’m so proud when I see people progress, and when I see that they’re gonna make it on their own.”

Learn More

- We2Gether Creating Change

- HOPE Credit Union provides financial services; aggregates resources; and engages in advocacy to mitigate the extent to which factors such as race, gender, birthplace and wealth limit one’s ability to prosper. Since 1994, HOPE has generated more than $2.9 billion in financing that has benefitted more than 1.7 million people in Alabama, Arkansas, Louisiana, Mississippi, and Tennessee.

- CNote – Interested in helping create another story like this? CNote makes it easy to invest in great Credit Unions like HOPE, helping you earn more while having a positive impact on businesses and communities across America.

Thankfully, Cortaiga didn’t have to close her business. Instead, she and her team are preparing to move into their new expanded center. To help get the word out, Cortaiga has been getting digital marketing assistance from a marketing and social impact consultant introduced to her through

Thankfully, Cortaiga didn’t have to close her business. Instead, she and her team are preparing to move into their new expanded center. To help get the word out, Cortaiga has been getting digital marketing assistance from a marketing and social impact consultant introduced to her through

Cortaiga’s vision for her slice of St. Louis — and her desire to help families break out of generational cycles of poverty and to purchase local homes

Cortaiga’s vision for her slice of St. Louis — and her desire to help families break out of generational cycles of poverty and to purchase local homes

For the next 13 years, John and Fern Street Circus continued to create memorable experiences in and around San Diego, and the community arts nonprofit quickly built a reputation for itself of providing people with unusual, albeit entertaining experiences close to home. Additionally, in 1993, Fern Street Circus launched a free-of-charge after-school program in the local recreation center. During that time, John learned a lot about how to create stories through circus and to make contact with diverse communities, and how to bring people together to mix and mingle around the spectacle, music, and acrobatics of his talented team of circus artists. “We want to talk to people in communities, and we want to be a way for people to come together,” John said. “Even if the story is subtle and doesn’t immediately hit people, it’s entertainment that they don’t usually see in their neighborhood parks.”

For the next 13 years, John and Fern Street Circus continued to create memorable experiences in and around San Diego, and the community arts nonprofit quickly built a reputation for itself of providing people with unusual, albeit entertaining experiences close to home. Additionally, in 1993, Fern Street Circus launched a free-of-charge after-school program in the local recreation center. During that time, John learned a lot about how to create stories through circus and to make contact with diverse communities, and how to bring people together to mix and mingle around the spectacle, music, and acrobatics of his talented team of circus artists. “We want to talk to people in communities, and we want to be a way for people to come together,” John said. “Even if the story is subtle and doesn’t immediately hit people, it’s entertainment that they don’t usually see in their neighborhood parks.”

While those community-based performances and classes buoyed the nonprofit’s spirits, it still required funding in order to remain operational; however, when PPP funding became available, John was skeptical that Fern Street Circus would even qualify. Unfortunately, neither of the big-name banks that the nonprofit had banked with for 30 years was helpful. After “striking out,” John received a note from

While those community-based performances and classes buoyed the nonprofit’s spirits, it still required funding in order to remain operational; however, when PPP funding became available, John was skeptical that Fern Street Circus would even qualify. Unfortunately, neither of the big-name banks that the nonprofit had banked with for 30 years was helpful. After “striking out,” John received a note from

At 70, John jokes that he’s not getting any younger, and although he’d like to remain involved with Fern Street Circus for a long, long time, he wants other leaders in the neighborhood — who, he says, don’t share his white privilege — to be a part of the organization’s long-term vision and future. “I want to phase myself out,” John said. “It’s not just about age. What has kept us vital is that we’re equal parts circus arts and social justice, and for us to be truly representative of a neighborhood as broad and diverse as ours, Fern Street Circus’ leadership needs to reflect that.”

At 70, John jokes that he’s not getting any younger, and although he’d like to remain involved with Fern Street Circus for a long, long time, he wants other leaders in the neighborhood — who, he says, don’t share his white privilege — to be a part of the organization’s long-term vision and future. “I want to phase myself out,” John said. “It’s not just about age. What has kept us vital is that we’re equal parts circus arts and social justice, and for us to be truly representative of a neighborhood as broad and diverse as ours, Fern Street Circus’ leadership needs to reflect that.”

Ethel went through 21 weeks of chemotherapy; yet, she didn’t let that keep her from her day job at

Ethel went through 21 weeks of chemotherapy; yet, she didn’t let that keep her from her day job at  Ethel went back to college to work toward receiving a bachelor’s degree in business management so that she’d be better equipped to manage her company. Meanwhile, in August 2019, Bennett Construction was awarded a $600,000 contract from Mobile Asphalt Company. That paved the way for Ethel to begin renting a building for her business and to land additional smaller contracts from the City of Mobile. Ethel’s next goal is to be certified as a Disadvantaged Business Enterprise (DBE), which will allow her to bid on bigger Department of Transportation contracts that will give her more income. Her primary goal is to become a General Contractor so that she can have other subcontractors working under her. Once she achieves that, Bennett Construction will be able to bid for contracts worth millions of dollars.

Ethel went back to college to work toward receiving a bachelor’s degree in business management so that she’d be better equipped to manage her company. Meanwhile, in August 2019, Bennett Construction was awarded a $600,000 contract from Mobile Asphalt Company. That paved the way for Ethel to begin renting a building for her business and to land additional smaller contracts from the City of Mobile. Ethel’s next goal is to be certified as a Disadvantaged Business Enterprise (DBE), which will allow her to bid on bigger Department of Transportation contracts that will give her more income. Her primary goal is to become a General Contractor so that she can have other subcontractors working under her. Once she achieves that, Bennett Construction will be able to bid for contracts worth millions of dollars. One Step at a Time

One Step at a Time Incredibly, as Bennett Construction continues to grow and to land more and more work across both Mobile and Alabama, Ethel has continued to work her 8 a.m. to 5 p.m. job at Franklin Primary Health Center. She’s thankful that her supervisors have been so flexible and understanding with the arrangement, as sometimes Ethel has to go to a job site for Bennett Construction during working hours; however, once she gets her DBE and primary contractor licenses, Ethel doesn’t think she’s going to be able to balance both jobs with her side hustle. Instead, she’s readying herself to make Bennett Construction her main focus. Mr.

Incredibly, as Bennett Construction continues to grow and to land more and more work across both Mobile and Alabama, Ethel has continued to work her 8 a.m. to 5 p.m. job at Franklin Primary Health Center. She’s thankful that her supervisors have been so flexible and understanding with the arrangement, as sometimes Ethel has to go to a job site for Bennett Construction during working hours; however, once she gets her DBE and primary contractor licenses, Ethel doesn’t think she’s going to be able to balance both jobs with her side hustle. Instead, she’s readying herself to make Bennett Construction her main focus. Mr.  When asked whether or not she’d believe it if someone told her 20 years ago that she’d own and operate a construction company in 2021, Ethel laughed. Despite the fact that Bennett Construction wasn’t in the cards for her until relatively recently, Ethel loves her company and the work that it produces. Unsurprisingly, it’s getting the chance to see and hear about Bennett Construction’s good work in and around Mobile that brings her the most joy, and she continues to be motivated by the knowledge that she’s building a financial legacy for her family that will outlive her. “As a Black woman running a business,” Ethel said, “there are a lot of opportunities for me. All I need to do is to get to those opportunities, and that’s what my focus is on now. Getting those certifications, and getting those opportunities.”

When asked whether or not she’d believe it if someone told her 20 years ago that she’d own and operate a construction company in 2021, Ethel laughed. Despite the fact that Bennett Construction wasn’t in the cards for her until relatively recently, Ethel loves her company and the work that it produces. Unsurprisingly, it’s getting the chance to see and hear about Bennett Construction’s good work in and around Mobile that brings her the most joy, and she continues to be motivated by the knowledge that she’s building a financial legacy for her family that will outlive her. “As a Black woman running a business,” Ethel said, “there are a lot of opportunities for me. All I need to do is to get to those opportunities, and that’s what my focus is on now. Getting those certifications, and getting those opportunities.”

Instead, what McAuley does offer in-house is a family-centered, evidence-based suite of supportive and clinically oriented- services that help families break the generational cycles of addiction and poverty. These services range from preparing women to re-enter higher education to providing cooking classes and workshops on healthy eating; however, before any of that can happen, McAuley staff work with women to help them stabilize physically, mentally, and emotionally so that they can reunify with their children if they’ve been separated. That includes one-on-one coaching as well as group sessions on parenting education. According to Melissa, she and her team are most often able to reunify women with their children within the first three to five months of their stay at McAuley.

Instead, what McAuley does offer in-house is a family-centered, evidence-based suite of supportive and clinically oriented- services that help families break the generational cycles of addiction and poverty. These services range from preparing women to re-enter higher education to providing cooking classes and workshops on healthy eating; however, before any of that can happen, McAuley staff work with women to help them stabilize physically, mentally, and emotionally so that they can reunify with their children if they’ve been separated. That includes one-on-one coaching as well as group sessions on parenting education. According to Melissa, she and her team are most often able to reunify women with their children within the first three to five months of their stay at McAuley.

Unsurprisingly, demand to get into McAuley Residence is high. Therefore, McAuley Residence wanted to open a second location. Fortunately, in 2019, Maine’s legislature passed a law called

Unsurprisingly, demand to get into McAuley Residence is high. Therefore, McAuley Residence wanted to open a second location. Fortunately, in 2019, Maine’s legislature passed a law called  Melissa and her team at McAuley often get asked the same question: “why don’t you expand more.” With ongoing support from The Genesis Fund, that’s exactly their plan, and with fatal overdoses up 27% in Maine and a pandemic that’s compounded the opioid crisis, the need has never been greater. Although Melissa is worried about the increase, she feels privileged that McAuley has been able to continue to screen and accept families in these difficult times. “The ability to really serve families in a comprehensive way is lacking across the United States,” Melissa said, “so we’re thrilled to be able to partner with Genesis to create an approach for both mother and child in a way that delivers remarkable outcomes. It’s really the right resource to fund because we’re truly seeing a direct benefit to families in our community.”

Melissa and her team at McAuley often get asked the same question: “why don’t you expand more.” With ongoing support from The Genesis Fund, that’s exactly their plan, and with fatal overdoses up 27% in Maine and a pandemic that’s compounded the opioid crisis, the need has never been greater. Although Melissa is worried about the increase, she feels privileged that McAuley has been able to continue to screen and accept families in these difficult times. “The ability to really serve families in a comprehensive way is lacking across the United States,” Melissa said, “so we’re thrilled to be able to partner with Genesis to create an approach for both mother and child in a way that delivers remarkable outcomes. It’s really the right resource to fund because we’re truly seeing a direct benefit to families in our community.” Learn More

Learn More

For Montina, her leap of faith paid off. She discovered that she really enjoyed working with lawyers, and she spent the next five years creating video content and doing digital marketing for legal industry clients — and making her first million dollars in revenue. Montina developed a recurring revenue model blueprint, where she and her team don’t just create one video for a client, but a series of videos that she calls a heat map, which includes highlighting the clients’ stories and thought leadership.

For Montina, her leap of faith paid off. She discovered that she really enjoyed working with lawyers, and she spent the next five years creating video content and doing digital marketing for legal industry clients — and making her first million dollars in revenue. Montina developed a recurring revenue model blueprint, where she and her team don’t just create one video for a client, but a series of videos that she calls a heat map, which includes highlighting the clients’ stories and thought leadership. Montina also credits her CDFI partners with giving her the ability to read her cash flow statement, profit and loss statement, and balance sheet. Additionally, both CDFIs provided Montina with the support she needed to get her paperwork, her financials, and her business plan in order. For example, ACE helped to liaise (and sponsor) her relationship with a local bookkeeping company. “With ACE, we have a financial consultant that I meet with two hours every single month,” she said. “And because I understand my books, I’m confident. She helps me set my monthly goals and my goals for the year, and really, it gives me a sense of relief to have accountability partners that actually care.”

Montina also credits her CDFI partners with giving her the ability to read her cash flow statement, profit and loss statement, and balance sheet. Additionally, both CDFIs provided Montina with the support she needed to get her paperwork, her financials, and her business plan in order. For example, ACE helped to liaise (and sponsor) her relationship with a local bookkeeping company. “With ACE, we have a financial consultant that I meet with two hours every single month,” she said. “And because I understand my books, I’m confident. She helps me set my monthly goals and my goals for the year, and really, it gives me a sense of relief to have accountability partners that actually care.” Montina has also taken advantage of the various educational workshops, professional gatherings, and speaking engagements offered by both CDFIs. She says that such opportunities are especially important for BIPOC and women entrepreneurs, who don’t often have mentors or family members who’ve owned and operated successful businesses. Those professional development and networking opportunities are just one of the many reasons that led Montina to become such a cheerleader — and advocate — for CDFIs. “I love, love, love, CDFIs,” she said. “CDFIs educate you about the loans you’re taking out, they look at your business plan, and they want to grow and scale with your business. They’re truly phenomenal.”

Montina has also taken advantage of the various educational workshops, professional gatherings, and speaking engagements offered by both CDFIs. She says that such opportunities are especially important for BIPOC and women entrepreneurs, who don’t often have mentors or family members who’ve owned and operated successful businesses. Those professional development and networking opportunities are just one of the many reasons that led Montina to become such a cheerleader — and advocate — for CDFIs. “I love, love, love, CDFIs,” she said. “CDFIs educate you about the loans you’re taking out, they look at your business plan, and they want to grow and scale with your business. They’re truly phenomenal.” When the Mentee Becomes the Mentor

When the Mentee Becomes the Mentor

TruFund was also able to help Alexia to navigate the second round of PPP funding, and today, business at The Sports and Wellness Doc is booming. According to Alexia, the pandemic, in a way, has turned out to be good for her business, as the pivot to remote working has left a lot of people with low back, shoulder, and neck pain caused by poor ergonomics and bad workspaces at home. Amazingly, Alexia, who is also a graduate of the

TruFund was also able to help Alexia to navigate the second round of PPP funding, and today, business at The Sports and Wellness Doc is booming. According to Alexia, the pandemic, in a way, has turned out to be good for her business, as the pivot to remote working has left a lot of people with low back, shoulder, and neck pain caused by poor ergonomics and bad workspaces at home. Amazingly, Alexia, who is also a graduate of the

Poppin’ Into The Future

Poppin’ Into The Future

On a personal note, Tanesha says that in the coming years, she’d also like to strike a better balance between work and home. That includes one day getting to a point where she doesn’t have to continually stay up until 3 a.m., which she currently does to both maximize time with her children and run her business. “I just always say, if you’re going to doubt anything, doubt your limits,” Tanesha said. “Do it scared, do it tired, and do it with purpose. And educate yourself. As an entrepreneur, that’s where you can stay sharp and make sure you’re making the right decisions for your business. That’s my mantra.”

On a personal note, Tanesha says that in the coming years, she’d also like to strike a better balance between work and home. That includes one day getting to a point where she doesn’t have to continually stay up until 3 a.m., which she currently does to both maximize time with her children and run her business. “I just always say, if you’re going to doubt anything, doubt your limits,” Tanesha said. “Do it scared, do it tired, and do it with purpose. And educate yourself. As an entrepreneur, that’s where you can stay sharp and make sure you’re making the right decisions for your business. That’s my mantra.”

That mindset is partly what drove Aimee to enlist in the Army, where she met Preston. In a time before cell phones and the internet, the two would spend time in their one-bedroom apartment in Killeen, Texas flipping through copies of Log Home Living, dog-earing pages, and cutting out pictures that they both liked. “We always had that dream of where we wanted to end up,” Preston said.

That mindset is partly what drove Aimee to enlist in the Army, where she met Preston. In a time before cell phones and the internet, the two would spend time in their one-bedroom apartment in Killeen, Texas flipping through copies of Log Home Living, dog-earing pages, and cutting out pictures that they both liked. “We always had that dream of where we wanted to end up,” Preston said. Aimee and Preston decided to do everything they could to raise the capital they needed to buy the resort. That’s how they got connected with

Aimee and Preston decided to do everything they could to raise the capital they needed to buy the resort. That’s how they got connected with  From start to finish, the purchase took roughly six months to go through: six months that Aimee describes as an emotional rollercoaster. However, given both the global pandemic and the nuances of lining up seven funding streams, the two feel blessed that they were able to make it to their closing on November 3, 2020, which was attended by Lakewood Lodge’s previous owners, the Osbornes, and Entrepreneur Fund staff members. According to the couple, there were a lot of tears, but they didn’t feel nervous about what was next: owning and operating a 14-cabin resort.

From start to finish, the purchase took roughly six months to go through: six months that Aimee describes as an emotional rollercoaster. However, given both the global pandemic and the nuances of lining up seven funding streams, the two feel blessed that they were able to make it to their closing on November 3, 2020, which was attended by Lakewood Lodge’s previous owners, the Osbornes, and Entrepreneur Fund staff members. According to the couple, there were a lot of tears, but they didn’t feel nervous about what was next: owning and operating a 14-cabin resort. Welcome to Your Dream

Welcome to Your Dream

“The spirit of Lakewood Lodge isn’t about the buildings,” Aimee said, of returning to where she grew up. “It’s really about this land and this area and the people that come up here and enjoy it. There’s more than fishing. There’s the northern lights and sitting by the bonfire and enjoying friends and family and the lake. It’s about the simpler things in life that we don’t take the time to stop and do often enough. It’s just what we wanted.”

“The spirit of Lakewood Lodge isn’t about the buildings,” Aimee said, of returning to where she grew up. “It’s really about this land and this area and the people that come up here and enjoy it. There’s more than fishing. There’s the northern lights and sitting by the bonfire and enjoying friends and family and the lake. It’s about the simpler things in life that we don’t take the time to stop and do often enough. It’s just what we wanted.”

From the moment Onna learned about CDFIs, she knew she wanted to get involved and be a part of one. She left her 15-year tenure with the federal government, became a consultant, and returned to the classroom to get her master’s degree in community development. Five-and-a-half years ago, she was offered her dream job at BHCLF.

From the moment Onna learned about CDFIs, she knew she wanted to get involved and be a part of one. She left her 15-year tenure with the federal government, became a consultant, and returned to the classroom to get her master’s degree in community development. Five-and-a-half years ago, she was offered her dream job at BHCLF. Given the realities of living in Rapid City, when BHCLF reached a point where it could hire two full-time staff members, Onna wanted

Given the realities of living in Rapid City, when BHCLF reached a point where it could hire two full-time staff members, Onna wanted  Onna says that her team’s ability to relate to BHCLF’s clients — or rather, BHCLF’s clients’ ability to relate to her team — is one of the ways the CDFI has been able to build trust and find success in its community outreach efforts. Additionally, all of BHCLF’s curriculum is Native-based, which is another way the CDFI has been able to build trusting relationships with its clients and establish itself as a recognizable placeholder in its community. In fact, unlike other CDFIs, lending isn’t BHCLF’s number one priority. Instead, its programmatic offerings are centered around financial education, mentorship for entrepreneurs, first-time homeownership, and youth outreach. According to Onna, each of these programs is about “getting people in the door.”

Onna says that her team’s ability to relate to BHCLF’s clients — or rather, BHCLF’s clients’ ability to relate to her team — is one of the ways the CDFI has been able to build trust and find success in its community outreach efforts. Additionally, all of BHCLF’s curriculum is Native-based, which is another way the CDFI has been able to build trusting relationships with its clients and establish itself as a recognizable placeholder in its community. In fact, unlike other CDFIs, lending isn’t BHCLF’s number one priority. Instead, its programmatic offerings are centered around financial education, mentorship for entrepreneurs, first-time homeownership, and youth outreach. According to Onna, each of these programs is about “getting people in the door.”

55% affordable housing lending

55% affordable housing lending

The Alliance has already experienced success with its advocacy efforts. For example, in the first iteration of the Small Business Administration’s Paycheck Protection Program, CDFIs were not included. However, thanks to voices like the Alliance’s, Congress has since emphasized and acknowledged the role that CDFIs play in keeping the country’s small businesses afloat. Congress allocated $12 billion to the

The Alliance has already experienced success with its advocacy efforts. For example, in the first iteration of the Small Business Administration’s Paycheck Protection Program, CDFIs were not included. However, thanks to voices like the Alliance’s, Congress has since emphasized and acknowledged the role that CDFIs play in keeping the country’s small businesses afloat. Congress allocated $12 billion to the  Incredibly, as the Alliance’s voice grows louder and louder in Washington D.C. and as the work of its member CDFIs ripples across Main Street U.S.A. Lenwood gives much credit to the Leadership Team of Donna Gambrell, Calvin Holmes, Victor Elmore, Inez Long, and Van Hampton for the quality time they provide to move the work of the Alliance forward.

Incredibly, as the Alliance’s voice grows louder and louder in Washington D.C. and as the work of its member CDFIs ripples across Main Street U.S.A. Lenwood gives much credit to the Leadership Team of Donna Gambrell, Calvin Holmes, Victor Elmore, Inez Long, and Van Hampton for the quality time they provide to move the work of the Alliance forward.

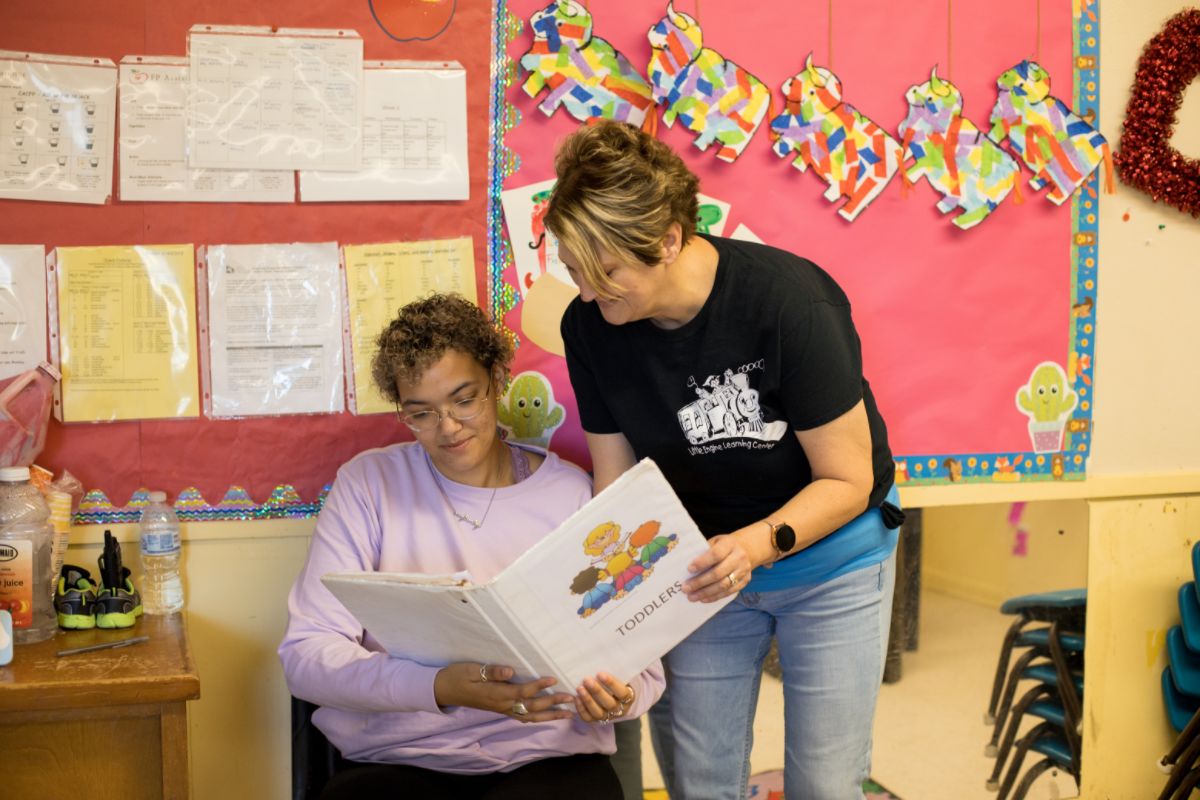

Considering what she’d been through, starting an in-home daycare didn’t seem daunting to Tawnya, who, at 30, became a mother and wanted to work from home while she raised her daughter. With support from her husband and sister-in-law, she opened up the family home for business. Eleven years later, she wanted something bigger.

Considering what she’d been through, starting an in-home daycare didn’t seem daunting to Tawnya, who, at 30, became a mother and wanted to work from home while she raised her daughter. With support from her husband and sister-in-law, she opened up the family home for business. Eleven years later, she wanted something bigger.

“In spite of their behavior, you have to love these kids beyond where they are,” she said. “We don’t really know what goes on at home, so I just love them and we make things work.”

“In spite of their behavior, you have to love these kids beyond where they are,” she said. “We don’t really know what goes on at home, so I just love them and we make things work.” Given her own personal journey, Tawnya has a particularly soft spot for homeless individuals, and she helps with providing food and medical supplies however she can. She also buys groceries for families in need, and she’s helping to organize a diaper, baby wipe, and food distribution in her community.

Given her own personal journey, Tawnya has a particularly soft spot for homeless individuals, and she helps with providing food and medical supplies however she can. She also buys groceries for families in need, and she’s helping to organize a diaper, baby wipe, and food distribution in her community.

Primm has been working with The Genesis Fund since Knox County Homeless Coalition’s early days when the CDFI helped the nonprofit acquire its first shelter and plot of land. A couple of years later, The Genesis Fund financed Primm and her team so that they could purchase the adjacent property, which now houses the coalition’s offices, food pantry, and supply depot. The collective land, which Knox County Homeless Coalition owns, is big enough for the nonprofit to one day build tiny houses, which will expand its shelter capacity. Additionally, early in their partnership, Knox County Homeless Coalition had a line of credit with The Genesis Fund, which has since been paid off. “Genesis really invested in getting to know our mission, our aspirations, and us early on,” Primm said. “They’re always so generous with their time, wisdom, and advice.”

Primm has been working with The Genesis Fund since Knox County Homeless Coalition’s early days when the CDFI helped the nonprofit acquire its first shelter and plot of land. A couple of years later, The Genesis Fund financed Primm and her team so that they could purchase the adjacent property, which now houses the coalition’s offices, food pantry, and supply depot. The collective land, which Knox County Homeless Coalition owns, is big enough for the nonprofit to one day build tiny houses, which will expand its shelter capacity. Additionally, early in their partnership, Knox County Homeless Coalition had a line of credit with The Genesis Fund, which has since been paid off. “Genesis really invested in getting to know our mission, our aspirations, and us early on,” Primm said. “They’re always so generous with their time, wisdom, and advice.”

The second project is a bigger affordable housing project in Rockland that will include roughly 20 units of affordable housing, including four to six Habitat for Humanity home-ownership homes. The development will be situated on a single piece of land, within walking distance to town, that was purchased with $500,000 from the Maine State Housing Authority. According to Primm, the housing will be a mix of duplexes for families and small-footprint cottages for individuals or couples. Once the project is completed, Knox County Homeless Coalition will own the affordable housing units, and the nonprofit will incorporate them into its program offerings, where renters will benefit from not just a roof over their heads, but professional support on their path to stable sustainable independence, and the opportunity to build equity over time.

The second project is a bigger affordable housing project in Rockland that will include roughly 20 units of affordable housing, including four to six Habitat for Humanity home-ownership homes. The development will be situated on a single piece of land, within walking distance to town, that was purchased with $500,000 from the Maine State Housing Authority. According to Primm, the housing will be a mix of duplexes for families and small-footprint cottages for individuals or couples. Once the project is completed, Knox County Homeless Coalition will own the affordable housing units, and the nonprofit will incorporate them into its program offerings, where renters will benefit from not just a roof over their heads, but professional support on their path to stable sustainable independence, and the opportunity to build equity over time.

Primm hopes that COVID-19 illuminates the state’s lack of an organized emergency response system that addresses homelessness as part of protecting public health. “The silver lining is that COVID has shed light on this for the first time,” she said. “People are more aware of it and more aware of what we are working on, and affordable housing needs are definitely on the radar—where they should be.

Primm hopes that COVID-19 illuminates the state’s lack of an organized emergency response system that addresses homelessness as part of protecting public health. “The silver lining is that COVID has shed light on this for the first time,” she said. “People are more aware of it and more aware of what we are working on, and affordable housing needs are definitely on the radar—where they should be.

That doesn’t mean that the transition was easy for Cheri. Instead, Cheri soon learned that there was a stark distinction between the food bank and Habitat for Humanity in terms of being able to meet the needs of the community. Whereas the food bank had a steady supply of food coming in and the nonprofit could meet the needs of almost every family that walked through its doors, Habitat for Humanity was the opposite. Cheri says that for every 100 families that approached her and her team, they could maybe help one of them — in two or three years. “That wasn’t good enough,” she said. “And that became my personal motivation.”

That doesn’t mean that the transition was easy for Cheri. Instead, Cheri soon learned that there was a stark distinction between the food bank and Habitat for Humanity in terms of being able to meet the needs of the community. Whereas the food bank had a steady supply of food coming in and the nonprofit could meet the needs of almost every family that walked through its doors, Habitat for Humanity was the opposite. Cheri says that for every 100 families that approached her and her team, they could maybe help one of them — in two or three years. “That wasn’t good enough,” she said. “And that became my personal motivation.”

According to Cheri, IDF’s ability to make sure that Greeley-Weld Habitat for Humanity doesn’t just look good on paper but actually is good on paper has allowed it to attract larger projects, investors, and donors. For example, recently, a reputable, multi-density development and building company approached Cheri and told her that it wanted to donate 30 acres of land — a $16 million value — to Habitat so it could build 184 lots of affordable housing in Greeley

According to Cheri, IDF’s ability to make sure that Greeley-Weld Habitat for Humanity doesn’t just look good on paper but actually is good on paper has allowed it to attract larger projects, investors, and donors. For example, recently, a reputable, multi-density development and building company approached Cheri and told her that it wanted to donate 30 acres of land — a $16 million value — to Habitat so it could build 184 lots of affordable housing in Greeley Building Affordable Housing for Everyone

Building Affordable Housing for Everyone Since returning to Greeley, Cheri has grown deep roots in the community, and it’s not uncommon for her to walk down the street on any given day and run into a donor, an investor, a volunteer, or a family that she’s worked with at Habitat. Despite the joy that those encounters bring her, Cheri says that the most magical moments continue to be when she gets to introduce a family to their new home. “There’s just a look in their eyes,” Cheri said. “It’s relief, and it’s gratitude, and you can just see the sense that they can breathe knowing for certain that this is their home and that things are going to be okay for their future. It’s just such an honor and privilege to be a part of that.”

Since returning to Greeley, Cheri has grown deep roots in the community, and it’s not uncommon for her to walk down the street on any given day and run into a donor, an investor, a volunteer, or a family that she’s worked with at Habitat. Despite the joy that those encounters bring her, Cheri says that the most magical moments continue to be when she gets to introduce a family to their new home. “There’s just a look in their eyes,” Cheri said. “It’s relief, and it’s gratitude, and you can just see the sense that they can breathe knowing for certain that this is their home and that things are going to be okay for their future. It’s just such an honor and privilege to be a part of that.”

The experience filled Michea with excitement and led her to alter her career trajectory. The Howard University alumna enrolled in a graduate program at Texas Woman’s University (TWU) and set out to research what would be the most effective way to blend language and services with children with autism and language delay. It was through her clinical placements at TWU that Michea discovered that she had an innate talent for working with young children as a speech-language pathologist.

The experience filled Michea with excitement and led her to alter her career trajectory. The Howard University alumna enrolled in a graduate program at Texas Woman’s University (TWU) and set out to research what would be the most effective way to blend language and services with children with autism and language delay. It was through her clinical placements at TWU that Michea discovered that she had an innate talent for working with young children as a speech-language pathologist.

That night, Michea sent TruFund an email. Like other entrepreneurs enrolled in the CDFI’s resiliency class, she was able to receive real-time information about PPP loans, and she was able to get everything that she needed in order so that when the time came to apply for assistance, she was ready to go. In the end, Michea received her PPP loan from TruFund, and although the amount wasn’t much, it was enough to give her business the momentum it needed to survive.

That night, Michea sent TruFund an email. Like other entrepreneurs enrolled in the CDFI’s resiliency class, she was able to receive real-time information about PPP loans, and she was able to get everything that she needed in order so that when the time came to apply for assistance, she was ready to go. In the end, Michea received her PPP loan from TruFund, and although the amount wasn’t much, it was enough to give her business the momentum it needed to survive.

Bill was true to his word. Within 12 months, Tree Street Youth owned the building. Since 1992, The Genesis Fund has been working to develop and support affordable housing and community facilities across Maine, mainly by providing both financing and technical assistance to community organizations and nonprofits like Tree Street Youth. CNote partners with CDFIs like The Genesis Fund in communities across the country, channeling capital to fund social missions like affordable housing, women’s empowerment, entrepreneurial funding, and more.

Bill was true to his word. Within 12 months, Tree Street Youth owned the building. Since 1992, The Genesis Fund has been working to develop and support affordable housing and community facilities across Maine, mainly by providing both financing and technical assistance to community organizations and nonprofits like Tree Street Youth. CNote partners with CDFIs like The Genesis Fund in communities across the country, channeling capital to fund social missions like affordable housing, women’s empowerment, entrepreneurial funding, and more. In addition to providing the loan itself, The Genesis Fund provided Tree Street Youth with bridge lending so that the nonprofit didn’t have to stop construction while it continued to fundraise. More so, Bill and his team worked alongside Julia throughout the construction and renovation experience, lending their industry know-how and expertise. “Providing those loans was critical,” Julia said, “but having Bill and Liza [Fleming-Ives] as my point people was invaluable because it gave me more confidence. We would not be where we are, or potentially even exist if they had not essentially taken a risk to want to support us.”

In addition to providing the loan itself, The Genesis Fund provided Tree Street Youth with bridge lending so that the nonprofit didn’t have to stop construction while it continued to fundraise. More so, Bill and his team worked alongside Julia throughout the construction and renovation experience, lending their industry know-how and expertise. “Providing those loans was critical,” Julia said, “but having Bill and Liza [Fleming-Ives] as my point people was invaluable because it gave me more confidence. We would not be where we are, or potentially even exist if they had not essentially taken a risk to want to support us.”

Prior to the COVID-19 pandemic, Tree Street Youth served between 600 and 700 children (pre-kindergarten to 12 grade) annually. Today, however, the organization is only able to serve roughly 100 students in person, and given the realities of the pandemic, much of the current work being done by the nonprofit is related to supporting students struggling with remote learning. Still, Julia is thankful that she and her team have a building where kids can come, spread out, and be safe, and despite the pandemic, Tree Street Youth is committed to offering year-round programming grounded in academic support, leadership development, and social-emotional enrichment, the latter of which was created and designed in partnership with Maine’s Department of Corrections to be both preventative and responsive to youth who come into contact with the juvenile justice system.

Prior to the COVID-19 pandemic, Tree Street Youth served between 600 and 700 children (pre-kindergarten to 12 grade) annually. Today, however, the organization is only able to serve roughly 100 students in person, and given the realities of the pandemic, much of the current work being done by the nonprofit is related to supporting students struggling with remote learning. Still, Julia is thankful that she and her team have a building where kids can come, spread out, and be safe, and despite the pandemic, Tree Street Youth is committed to offering year-round programming grounded in academic support, leadership development, and social-emotional enrichment, the latter of which was created and designed in partnership with Maine’s Department of Corrections to be both preventative and responsive to youth who come into contact with the juvenile justice system. “Tree Street literally grew out of the community, no pun intended,” Julia said. “There’s been so much influence from so many people over the years. It’s an example of what can truly happen when every member of a community comes together to support their kids, and how empowered kids can truly change a whole community.”

“Tree Street literally grew out of the community, no pun intended,” Julia said. “There’s been so much influence from so many people over the years. It’s an example of what can truly happen when every member of a community comes together to support their kids, and how empowered kids can truly change a whole community.”

Whereas ACE has been right there next to Felicia throughout the pandemic, notably absent were her sons, who left the family business nearly two years ago to begin their own entrepreneurial ventures. Today, they both have their own successful businesses, one in Atlanta, and the other in Vietnam. For someone like Felicia, who opened a franchise to show her kids how to run a business, their success is what drives her to create those same opportunities for her employees.

Whereas ACE has been right there next to Felicia throughout the pandemic, notably absent were her sons, who left the family business nearly two years ago to begin their own entrepreneurial ventures. Today, they both have their own successful businesses, one in Atlanta, and the other in Vietnam. For someone like Felicia, who opened a franchise to show her kids how to run a business, their success is what drives her to create those same opportunities for her employees. Felicia’s lead-by-example mentality, along with the mentorship she provides her employees, takes many forms, including facilitating staff training sessions on financial literacy topics like filing taxes, budgeting, balancing checkbooks, and opening (and managing) a bank account. In Felicia’s mind, by investing in her employees’ futures, she’s taking the good fortune that she’s been dealt in life and paying it forward.

Felicia’s lead-by-example mentality, along with the mentorship she provides her employees, takes many forms, including facilitating staff training sessions on financial literacy topics like filing taxes, budgeting, balancing checkbooks, and opening (and managing) a bank account. In Felicia’s mind, by investing in her employees’ futures, she’s taking the good fortune that she’s been dealt in life and paying it forward. “I didn’t grow up wealthy,” she said. “I grew up in one of those situations where a lot of kids don’t make it through; but, I was blessed enough to make it. So, I just always want kids to know, no matter where you are, you can bring yourself out of that with hard work and dedication and commitment and focus, and you can get anywhere you want to be.”

“I didn’t grow up wealthy,” she said. “I grew up in one of those situations where a lot of kids don’t make it through; but, I was blessed enough to make it. So, I just always want kids to know, no matter where you are, you can bring yourself out of that with hard work and dedication and commitment and focus, and you can get anywhere you want to be.”

CNote: What led you to become a financial coach for women of color?

CNote: What led you to become a financial coach for women of color? CNote: What would you say the need is for this kind of coaching, and are there other coaches like you out there?

CNote: What would you say the need is for this kind of coaching, and are there other coaches like you out there? CNote: How has the COVID-19 pandemic affected women of color?

CNote: How has the COVID-19 pandemic affected women of color?

Gloria and her siblings, spread between first grade and eleventh grade, were the only Black students in the school. Their peers threw chalk at them and showered them with spitballs. White students terrorized them in the hallways and called them terrible names, at home things were even worse. People fired guns into the house so that the family had to resort to sleeping on the floor, and people plowed their gardens and released their pigs. The family was even evicted from the plantation where they lived and worked.

Gloria and her siblings, spread between first grade and eleventh grade, were the only Black students in the school. Their peers threw chalk at them and showered them with spitballs. White students terrorized them in the hallways and called them terrible names, at home things were even worse. People fired guns into the house so that the family had to resort to sleeping on the floor, and people plowed their gardens and released their pigs. The family was even evicted from the plantation where they lived and worked.

This piece was authored by Danielle M. Burns, MBA, AIF®, VP of Business Development at CNote. She is also an internal champion of the Wisdom Fund and is leading the human-centered design work on this project.

This piece was authored by Danielle M. Burns, MBA, AIF®, VP of Business Development at CNote. She is also an internal champion of the Wisdom Fund and is leading the human-centered design work on this project.

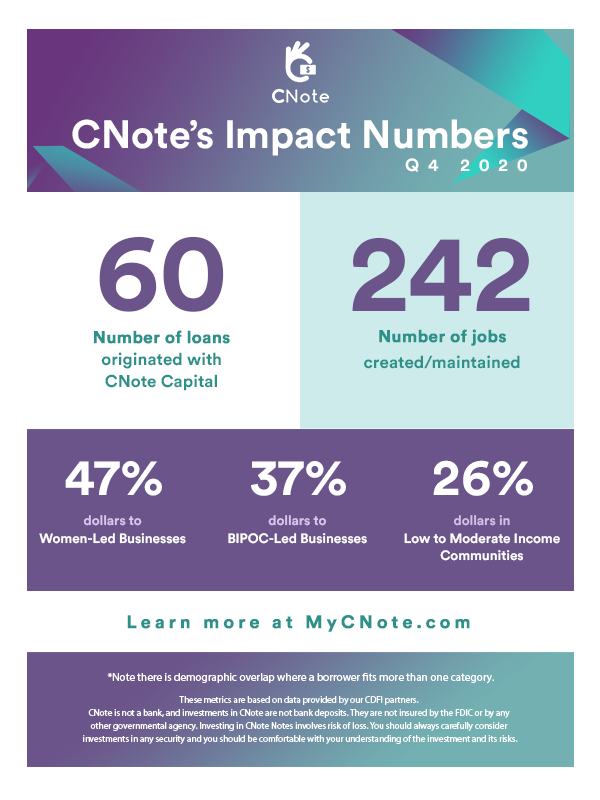

About CNote

About CNote

About CNote

About CNote

As Vanessa looks to potentially open a second Culinary Artistas location in the Bay Area, and as she ramps up her subscription business, she also wants to be sure that she’s working with her employees to help them actualize their own professional goals, whether that’s acting as an investor, a mentor, or a launching pad.

As Vanessa looks to potentially open a second Culinary Artistas location in the Bay Area, and as she ramps up her subscription business, she also wants to be sure that she’s working with her employees to help them actualize their own professional goals, whether that’s acting as an investor, a mentor, or a launching pad.

“We spoke very broken English,” Nola said, smiling. “But we went to school, and we learned the language. My mom had taught us that when there aren’t opportunities, you create your own. I had a vision of creating something for myself.

“We spoke very broken English,” Nola said, smiling. “But we went to school, and we learned the language. My mom had taught us that when there aren’t opportunities, you create your own. I had a vision of creating something for myself. V-Solutions partners with two major companies,

V-Solutions partners with two major companies,

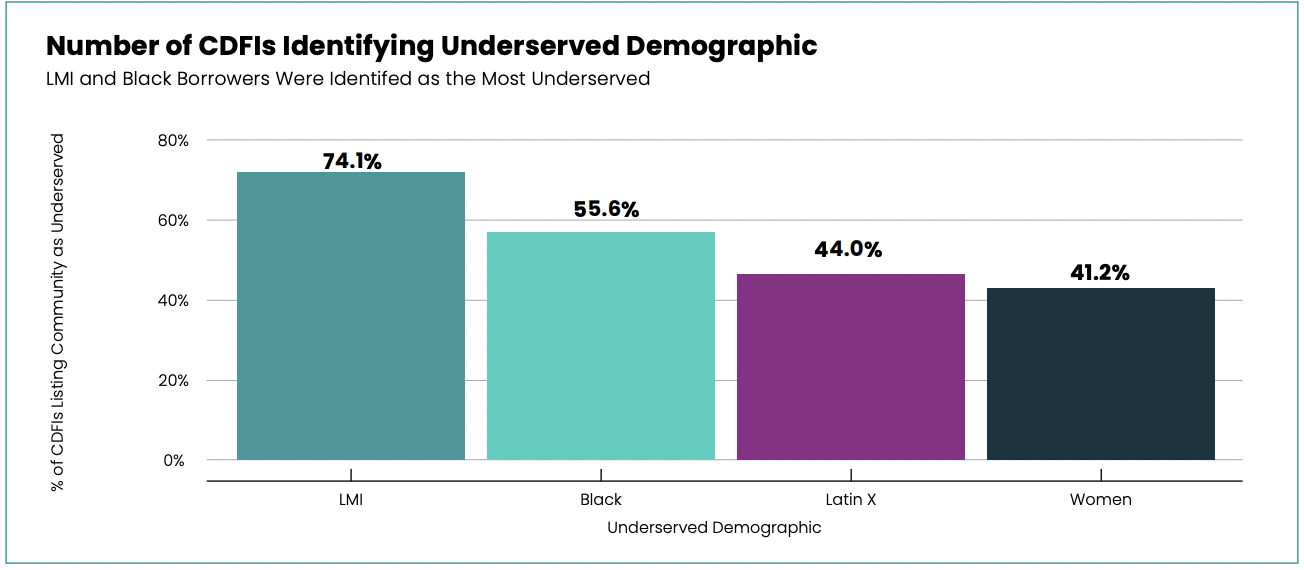

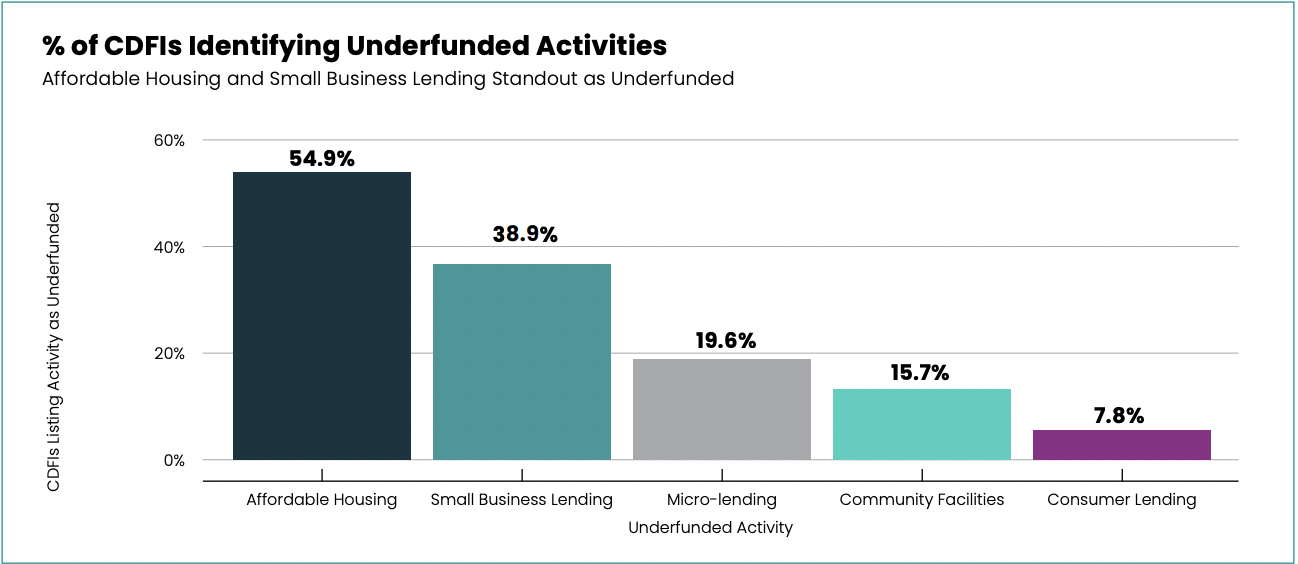

In a 2009 industry assessment, the

In a 2009 industry assessment, the

In their role as “financial first responders” CDFIs are perfectly suited to provide a rapid response to the pandemic. CDFIs have a long track record of absorbing economic turmoil and thriving during downturns while investing in underserved communities to help them weather unforeseen financial emergencies.

In their role as “financial first responders” CDFIs are perfectly suited to provide a rapid response to the pandemic. CDFIs have a long track record of absorbing economic turmoil and thriving during downturns while investing in underserved communities to help them weather unforeseen financial emergencies.

Dan Schulman, President and CEO at PayPal, shared these comments on this initiative “A critical component to closing the racial wealth gap is economically empowering underrepresented communities that have traditionally been shut out of opportunities to build and sustain wealth. Whether it’s helping someone purchase a home or open their own business, these institutions are on the front lines of creating financial stability and expanding opportunity for traditionally underserved communities. We are proud to partner with them as we work together to advance economic equity and racial justice.”