Secure, Impactful Cash Management

What is Impact Cash®?

Make a Difference with Your Money.

Impact Cash® is a secure and socially conscious cash management solution available to corporations, foundations, and individual investors. Every dollar you deposit is 100% FDIC/NCUA insured, giving you the security and peace of mind you need while helping to make a positive impact in underserved communities.

How It Works:

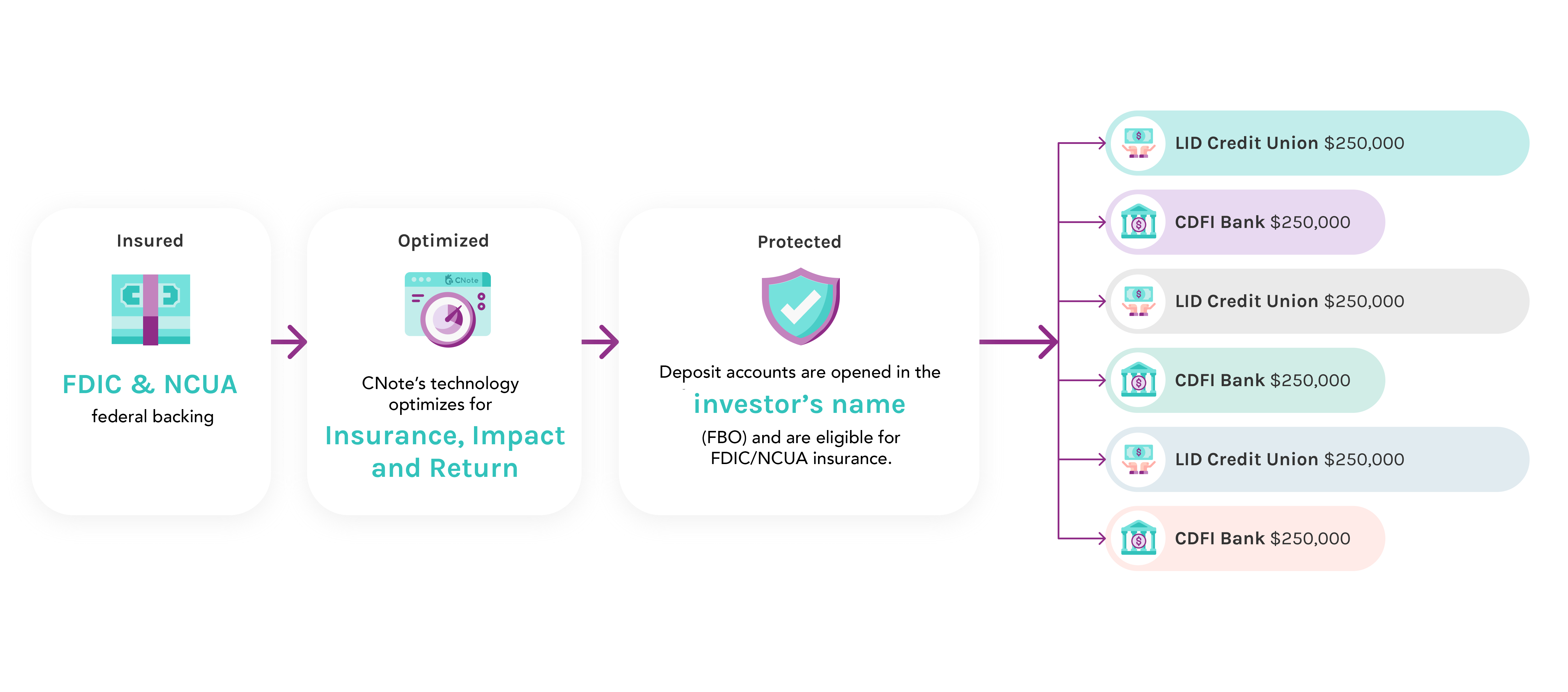

Your funds (100% FDIC/NCUA insured) are deposited into mission-driven financial institutions, including Community Development Financial Institutions (CDFIs) banks and credit unions. These institutions use deposits to fuel lending for causes such as affordable housing, small business growth, racial equity, and climate change.

With CNote’s evaluation and monitoring systems, you can trust that your money is making a real difference. Plus, you’ll receive annual impact reports, complete with metrics and stories illustrating how your deposits are driving meaningful change.

Why Choose Impact Cash®?

Peace of Mind

Fully insured deposits (100% FDIC/NCUA) ensure your funds are protected.

Competitive Market Returns*

Earn a competitive return while aligning your cash with your values.

Direct Impact

Support the causes you care about, from environmental sustainability to economic empowerment.

Effortless Management:

An easy-to-use online portal simplifies funds management, so you can focus on what matters most.

Where does my money go?

Impact Cash®. Optimized by CNote.

When you allocate your cash to Impact Cash®, CNote spreads your investment across partner banks and credit unions, optimizing for impact so you know your cash is earning a return while supporting underserved communities. Below are some examples of organizations and borrowers that have received financial assistance from Impact Cash® program partners.

How does it work?

Your Money. Your Impact.

Since January 2023, CNote’s partner institutions have:

- Provided $1.1 billion in affordable housing financing.

- Directed $2 billion in lending to BIPOC borrowers.

- Enabled $16.9 million in down payment assistance for homeowners.

Real Stories. Real Change.

Take Jeff Trudeau, for example. With support from a CNote Impact Cash® partner, Jeff turned his vision for Concrete Washout Solutions of New England into a thriving business. His company, focused on protecting local waterways, has doubled its sales while fostering environmental sustainability.

Who Can Use Impact Cash®?

Impact Cash® is available to:

- Individual Investors (minimum deposit of $50,000 required)

- Corporations and Foundations

Important Disclosures

CNote Group, Inc. is not a bank, a credit union, or any other type of financial institution. CNote is not a registered investment advisor with the Securities and Exchange Commission (SEC) or a broker-dealer authorized by the Financial Industry Regulatory Authority (FINRA). CNote is not a legal, financial, accounting or tax advisor. CNote does not negotiate interest rates. Impact Cash® deposits are not a security or investment. Impact Cash® deposits are insured by the FDIC or NCUA, subject to the terms and conditions of the Impact Cash® agreements. Information provided herein is for educational purposes only and is not tailored for any individual investor or client. It should not be relied upon as financial or investment advice. Any projected returns are illustrative, based on interest rates offered currently or in the past, which may be subject to change at any time, and may not reflect the ultimate rate of return. Past performance is no guarantee of future results, and future returns may vary.

Interested in Impact Cash®?