Cortaiga Collins: Redefining Community Impact

When we first introduced Cortaiga Collins in 2021, she was on the verge of a major milestone: opening the doors to a new, state-of-the-art facility for her thriving childcare business, Good Shepherd Preschool and Infant/Toddler Center. At the time, her story captivated readers as she shared her journey from being a single mom in search of quality childcare to becoming a visionary community leader dedicated to uplifting families in St. Louis.

Two years later, we’re catching up with Cortaiga to see how her work—and her bold vision—have continued to flourish. Spoiler: She hasn’t just met her goals; she’s exceeded them, building on her mission to create lasting change for her community.

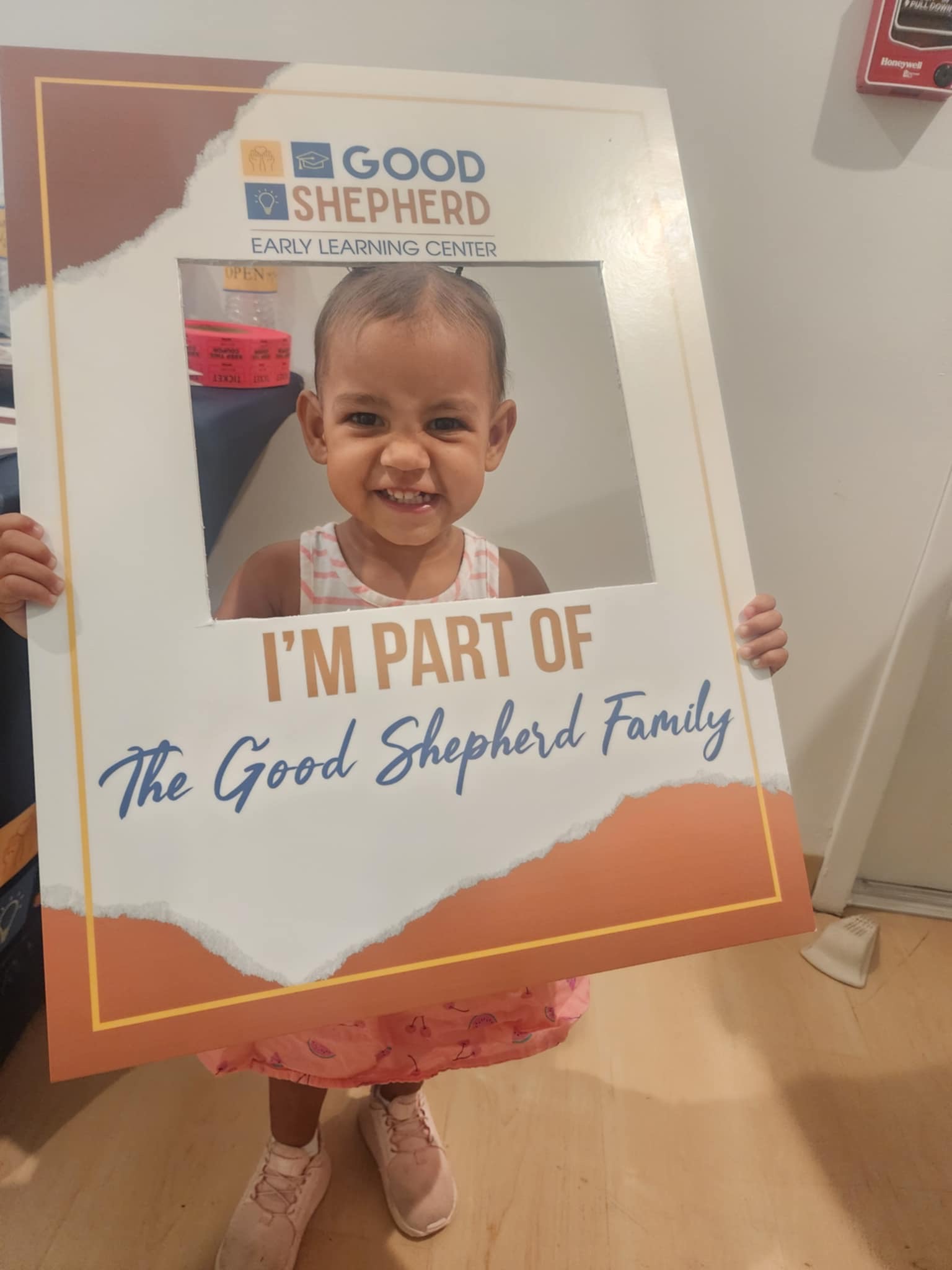

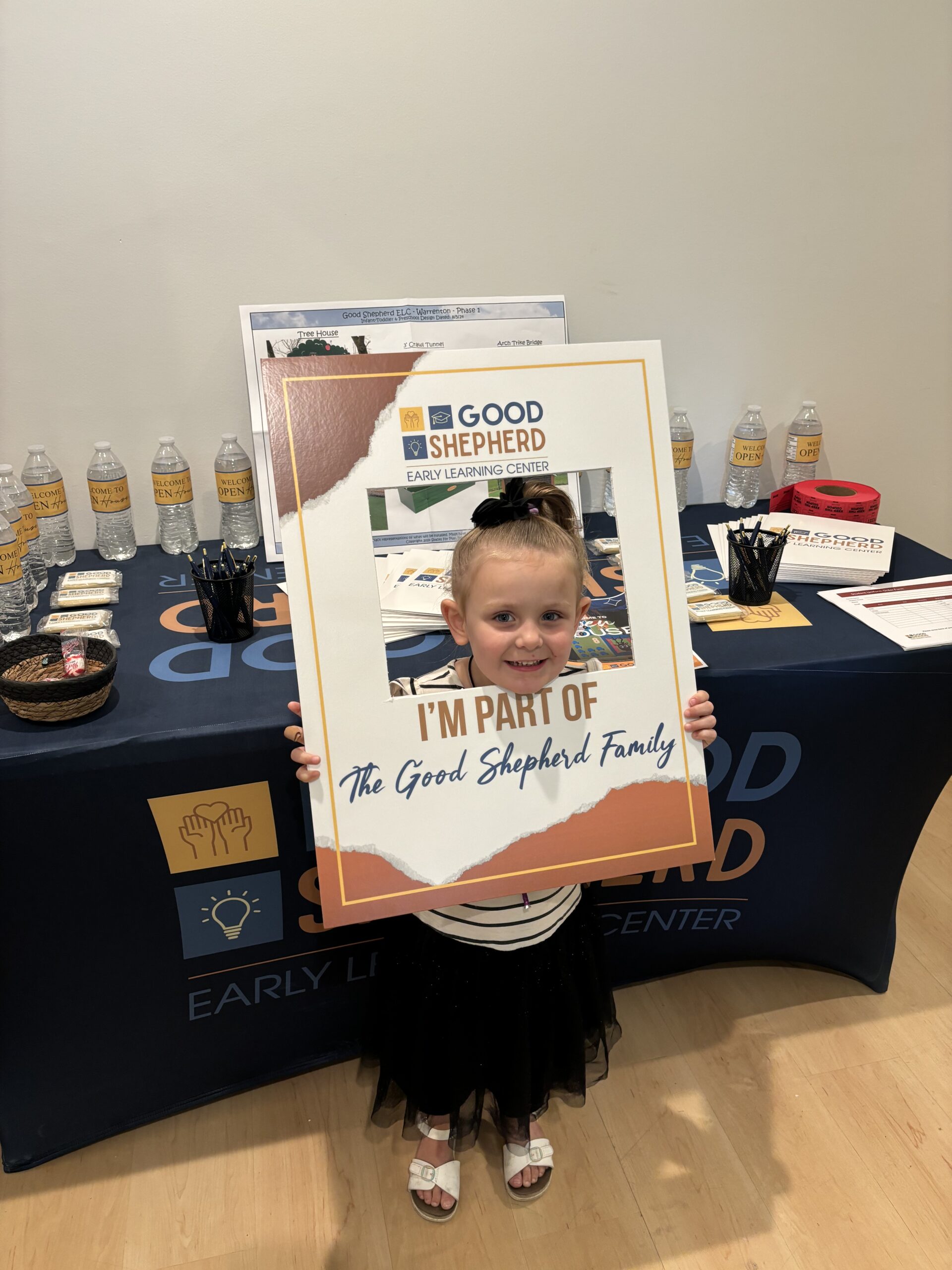

Cortaiga Collins, left, and her teammate from Good Shepherd Preschool

From Single Mom to Community Leader and Resilient Entrepreneur

Cortaiga Collins would be the first to tell you that she started her entrepreneurial journey as “a mom who wanted to find a safe place for her kids.” Over the last two decades, Cortaiga has transformed from a determined single mother into a community leader, shaping early childhood education and support systems for families across Missouri. Today, she stands at the helm of Good Shepherd Preschool and Infant/Toddler Center and her nonprofit, Foundation for Strengthening Families, driving innovative programs and partnerships that address the root causes of generational poverty.

Despite her tremendous success, Cortaiga remains humble, often brushing off praise for her achievements. “I’m just a mom who had a baby,” she shared in a recent conversation. “But I’ve stopped minimizing my work. I’ve realized, you know what? I am doing great things.”

Expanded Horizons

Since 2021, Good Shepherd Preschool has grown into a vibrant hub of learning and care. The new facility, which opened in July 2022, expanded its capacity from 32 to 97 children across seven classrooms. Every classroom is full, with families eager to enroll their children. “We’ve had to turn people away—not because there isn’t need, but because of staffing limits,” Cortaiga shared. The center has grown its staff to 18 and continues to focus on providing not just education but holistic support for children and their families.

Good Shepherd’s programming now includes a literacy lab, a space stocked with over 1,000 culturally relevant books written by Black authors. The lab helps foster a love of reading while celebrating African American experiences and art. The center also partners with therapists to provide social-emotional and mental health support for children facing behavioral challenges.

In parallel, Cortaiga has expanded the scope of her nonprofit, Foundation for Strengthening Families. The Show Me Family Zone, modeled after the Harlem Children’s Zone, is a cornerstone of her vision to provide multi-generational support services to Missouri, the “Show Me” state. This includes an upcoming initiative to create the Good Shepherd Academy for Boys, the nation’s first all-male preschool for Black boys. Scheduled to open in 2025, the academy will provide tuition-free education, focusing on academic preparation, social-emotional development, and cultural pride.

“We want these boys to walk into kindergarten not just ready to learn but proud of who they are and confident in their abilities,” Cortaiga explained. “When children start school prepared and supported, it changes their trajectory—and that of their communities.”

The nonprofit has also launched programs addressing Black maternal health disparities, offering resources like access to doulas, lactation specialists, and mental health professionals. “We’re working to improve health outcomes for both mothers and babies, because healthy families are the foundation of strong communities,” she said.

Mothers participating in maternity workshops offered by the Foundation for Strengthening Families

Cortaiga with Participants

In addition to her work in St. Louis, Cortaiga has extended her reach to Warrenton, Missouri, where her nonprofit opened a rural childcare center to meet the needs of low-income and foster families. “Families in Warrenton were driving over 20 miles to access childcare,” she explained. By renovating a local building, the center now provides high-quality care close to home, addressing a critical gap in the community.

Partnering for Sustainable Community Development

Cortaiga’s story is also one of collaboration. Since 2008, she has partnered with Justine PETERSEN (JP), a Community Development Financial Institution (CDFI) that provides critical financial and operational support to entrepreneurs in underserved communities. Justine PETERSEN is a CDFI included in CNote’s fixed income portfolio.

“Justine PETERSEN has been instrumental in helping us during tough times,” Cortaiga said. From providing startup loans to funding for food programs during the pandemic, JP has been a steady source of support. In 2024, when a statewide payment delay left childcare providers without subsidies for three months, JP offered working capital that allowed Good Shepherd to stay afloat.

“Our relationship has grown alongside Cortaiga’s business,” Aida Richardson, Chief Lending Officer at JP shared. “When she first came to us, she had personal credit challenges. Over the years, she’s worked hard to improve her credit and expand her business. Today, she’s secured traditional bank financing for her expansions—a testament to her dedication and vision.”

A Lasting Legacy

At the heart of everything Cortaiga does is a desire to create something enduring—a community ecosystem that uplifts families and empowers others to carry the work forward. “I don’t want to be the centerpiece,” she shared. “I want to build something that lasts, something that will continue to empower families and children long after I step away.”

Through partnerships with life coaches, social workers, and educators, Cortaiga ensures her staff is equipped with skills that extend far beyond the workplace. Her focus on mentorship and professional development is part of her vision for sustainability, laying the groundwork for future leaders to take the reins.

Her next major project, the Good Shepherd Academy for Boys, embodies this forward-thinking approach. “This isn’t just about a preschool,” she explained. “It’s about changing how Black boys are seen and treated, starting from the earliest years. We’re building a model that we hope will inspire and empower communities beyond St. Louis.”

Her next major project, the Good Shepherd Academy for Boys, embodies this forward-thinking approach. “This isn’t just about a preschool,” she explained. “It’s about changing how Black boys are seen and treated, starting from the earliest years. We’re building a model that we hope will inspire and empower communities beyond St. Louis.”

JP echoed Cortaiga’s determination to make an impact. “Cortaiga’s work is proof that meaningful change happens when vision and community come together,” Aida says. “We’re honored to continue supporting her as she brings these new ideas to life.”

As Cortaiga looks toward the future, she remains focused on the long game.

““This work isn’t just for today, it’s for generations to come. We’re laying a foundation that will help families thrive long after we’re gone.””

*CNote Group, Inc. is not a bank, a credit union, or any other type of financial institution. CNote is not a registered investment advisor with the Securities and Exchange Commission (SEC) or a broker-dealer authorized by the Financial Industry Regulatory Authority (FINRA). CNote is not a legal, financial, accounting or tax advisor. CNote does not negotiate interest rates. Impact Cash is not a security or investment. Impact Cash® deposits are insured by the FDIC or NCUA, subject to the terms and conditions of the Impact Cash® agreements. We encourage you to consult with a financial adviser or investment professional to determine whether or not the CNote platform makes sense for you.This information should not be relied upon as research, investment or financial advice. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Furthermore, a large component of Piedmont Community Services’ work is educational. The organization has strong partnerships with the local school systems, where it provides prevention and recovery services to youth and young adults. Similarly, Piedmont Community Services works closely with community partners to educate parents and adults in the area so that residents are better equipped to identify and refer friends and family members who might benefit from behavioral health services to reach out to the organization. “Our role is to make sure we take care of our community,” said Greg. “It’s our job to be accessible and to have solid services available that can make a difference in people’s lives.”

Furthermore, a large component of Piedmont Community Services’ work is educational. The organization has strong partnerships with the local school systems, where it provides prevention and recovery services to youth and young adults. Similarly, Piedmont Community Services works closely with community partners to educate parents and adults in the area so that residents are better equipped to identify and refer friends and family members who might benefit from behavioral health services to reach out to the organization. “Our role is to make sure we take care of our community,” said Greg. “It’s our job to be accessible and to have solid services available that can make a difference in people’s lives.”

That includes Arkansas and Mississippi, where HEC was selected to deploy state-level, Solar for All awards. HEC’s Solar for All proposal included financing models for solar and battery storage on single-family homes and multi-family affordable housing, as well as community solar.

That includes Arkansas and Mississippi, where HEC was selected to deploy state-level, Solar for All awards. HEC’s Solar for All proposal included financing models for solar and battery storage on single-family homes and multi-family affordable housing, as well as community solar.

That’s where

That’s where  Opportunity Credit Union’s Home Energy Loans aren’t the only loans it offers with interest rates as low as 0%. According to Kate, these zero-interest loans are made possible through grant dollars and funds that the credit union can access as a CDFI. For example, the credit union received a grant from

Opportunity Credit Union’s Home Energy Loans aren’t the only loans it offers with interest rates as low as 0%. According to Kate, these zero-interest loans are made possible through grant dollars and funds that the credit union can access as a CDFI. For example, the credit union received a grant from  Deploying Loans to Combat Climate Change

Deploying Loans to Combat Climate Change Climate Cash™ is the industry’s first 100% Carbon Positive deposit solution, enabling corporations to enjoy FDIC or NCUA insurance and competitive returns while contributing to carbon-reduction lending activities. Climate Cash™ enables corporations to deploy cash in the form of deposits into a network of mission-driven banks and credit unions like Opportunities Credit Union to combat climate change. Importantly, participating corporations can monitor, administer, and report their Climate Cash™ through a single interface.

Climate Cash™ is the industry’s first 100% Carbon Positive deposit solution, enabling corporations to enjoy FDIC or NCUA insurance and competitive returns while contributing to carbon-reduction lending activities. Climate Cash™ enables corporations to deploy cash in the form of deposits into a network of mission-driven banks and credit unions like Opportunities Credit Union to combat climate change. Importantly, participating corporations can monitor, administer, and report their Climate Cash™ through a single interface.  Learn More:

Learn More:

Today, as an agricultural lending partner, ChoiceOne Bank

Today, as an agricultural lending partner, ChoiceOne Bank

Learn More:

Learn More:

To assist his community where he can, Rich is working with local leaders to change how Beardstown’s tax increment financing (TIF) programming works so that a portion of those monies can go toward creating new housing. Additionally, Beardstown Savings has partnered with

To assist his community where he can, Rich is working with local leaders to change how Beardstown’s tax increment financing (TIF) programming works so that a portion of those monies can go toward creating new housing. Additionally, Beardstown Savings has partnered with

For Labor Credit Union, however, its involvement with Dora isn’t about growing its membership: it’s about achieving its own long-term goals. Although Thomas and Hina’s 10-year vision for the credit union includes growing its membership numbers, increasing its assets, and expanding its footprint into new markets, those metrics are stepping stones toward Labor Credit Union’s ultimate objective: to have an impact and help people achieve financial success in as many communities as possible.

For Labor Credit Union, however, its involvement with Dora isn’t about growing its membership: it’s about achieving its own long-term goals. Although Thomas and Hina’s 10-year vision for the credit union includes growing its membership numbers, increasing its assets, and expanding its footprint into new markets, those metrics are stepping stones toward Labor Credit Union’s ultimate objective: to have an impact and help people achieve financial success in as many communities as possible.  That, in part, is what led Labor Credit Union to create its own foundation, which spearheads the institution’s community outreach efforts.

That, in part, is what led Labor Credit Union to create its own foundation, which spearheads the institution’s community outreach efforts.  Learn More:

Learn More:

Learn More:

Learn More:

Although NYU Federal Credit Union’s assets have grown considerably since Mira joined in 2006, the credit union is still too small to carry a high number of mortgages on its balance sheet, despite the demand from its membership. Therefore, to meet its members’ needs, the credit union forged a partnership with the United Nations Federal Credit Union. NYU Federal Credit Union sells its mortgages to United Nations Federal Credit Union, but holds onto 10% of each loan. In return, United Nations Federal Credit Union gets to improve its balance sheet, while NYU Federal Credit Union gets to serve more members. Last year, the arrangement resulted in NYU Federal Credit Union earning approximately $400,000 in fees, which Mira says was a “huge boost” to the credit union’s bottom line.

Although NYU Federal Credit Union’s assets have grown considerably since Mira joined in 2006, the credit union is still too small to carry a high number of mortgages on its balance sheet, despite the demand from its membership. Therefore, to meet its members’ needs, the credit union forged a partnership with the United Nations Federal Credit Union. NYU Federal Credit Union sells its mortgages to United Nations Federal Credit Union, but holds onto 10% of each loan. In return, United Nations Federal Credit Union gets to improve its balance sheet, while NYU Federal Credit Union gets to serve more members. Last year, the arrangement resulted in NYU Federal Credit Union earning approximately $400,000 in fees, which Mira says was a “huge boost” to the credit union’s bottom line.

From their humble beginnings in the Red Barn with ten students on their roster, they now have over 100 kids and are setting their sights on obtaining college gymnastics scholarships.

From their humble beginnings in the Red Barn with ten students on their roster, they now have over 100 kids and are setting their sights on obtaining college gymnastics scholarships. Learn More:

Learn More:

Another way the credit union is able to support its members is by helping them to think beyond their financial wellness to other aspects of their lives. Azul has attended countless resource fairs, where she’s forged relationships with community partners. That has allowed her to build upon Comunidad Latina’s curated database of community resources that range from English courses and citizenship classes, to medical services and college enrollment assistance.

Another way the credit union is able to support its members is by helping them to think beyond their financial wellness to other aspects of their lives. Azul has attended countless resource fairs, where she’s forged relationships with community partners. That has allowed her to build upon Comunidad Latina’s curated database of community resources that range from English courses and citizenship classes, to medical services and college enrollment assistance.

A cornerstone of Freedom First’s work is its award-winning Responsible Rides® auto purchase program, which Kim has coordinated since September of 2015. The program is geared toward low- to moderate-income earners who need their own car but struggle to afford a traditional car loan due to credit challenges. Responsible Rides®, however, doesn’t just hand out car keys. Instead, applicants must meet specific guidelines, including having a valid driver’s license, the ability to have full-coverage auto insurance, and proof of employment that goes back at least 90 days. Applicants also can’t have more than $1,500 in unpaid collections, judgments, or charge-offs. Additionally, in order to qualify for Responsible Rides®, individuals must meet with a financial counselor and complete courses on finances and budgeting, as well as car maintenance and care.

A cornerstone of Freedom First’s work is its award-winning Responsible Rides® auto purchase program, which Kim has coordinated since September of 2015. The program is geared toward low- to moderate-income earners who need their own car but struggle to afford a traditional car loan due to credit challenges. Responsible Rides®, however, doesn’t just hand out car keys. Instead, applicants must meet specific guidelines, including having a valid driver’s license, the ability to have full-coverage auto insurance, and proof of employment that goes back at least 90 days. Applicants also can’t have more than $1,500 in unpaid collections, judgments, or charge-offs. Additionally, in order to qualify for Responsible Rides®, individuals must meet with a financial counselor and complete courses on finances and budgeting, as well as car maintenance and care.

Unsurprisingly, Kim finds her work with Responsible Rides® extremely rewarding—but she isn’t the only one who feels that way. Local used-car dealers also enjoy participating in the program. An important aspect of Responsible Rides® is that individuals have the option to pick their own car, including test driving it and getting it checked by a certified mechanic. Therefore, Kim does everything she can—including doing a fair bit of research—to ensure that Responsible Rides®’ clients have positive experiences getting their cars from dealerships.

Unsurprisingly, Kim finds her work with Responsible Rides® extremely rewarding—but she isn’t the only one who feels that way. Local used-car dealers also enjoy participating in the program. An important aspect of Responsible Rides® is that individuals have the option to pick their own car, including test driving it and getting it checked by a certified mechanic. Therefore, Kim does everything she can—including doing a fair bit of research—to ensure that Responsible Rides®’ clients have positive experiences getting their cars from dealerships. Relationships are one way that Kim has been able to originate 523 loans totaling $5.9 million since she began coordinating Responsible Rides eight years ago. Kim works closely with a network of local nonprofit partners, including

Relationships are one way that Kim has been able to originate 523 loans totaling $5.9 million since she began coordinating Responsible Rides eight years ago. Kim works closely with a network of local nonprofit partners, including

In 2019, The Cheyenne River Sioux Tribe approached Jayme with an offer to take over the management of their buffalo corporation, a business corporation which operates independently of, but is owned by, the tribe. For Jayme it was a perfect opportunity to bring his expertise to an organization near and dear to his heart.

In 2019, The Cheyenne River Sioux Tribe approached Jayme with an offer to take over the management of their buffalo corporation, a business corporation which operates independently of, but is owned by, the tribe. For Jayme it was a perfect opportunity to bring his expertise to an organization near and dear to his heart.